Let me preface this by warning everybody that the government in Washington exists to protect Alex Jones from his critics. I’ve learned that myself, as it is apparently a transgression to call for people to pray for Alex, that his eyes would be opened, as I did. Just a few days ago, Alex on his show spoke about “strafing” his opposition – literally. Listen to his show. I perceive that as somewhat of a threat. Welcome to the Alex Jones World Order. Several days ago – anterior to the faux news debate – Alex literally called for shutting down CNN. It’s Wolf Blitzer, not Alex Jones, helping us identify the torturers: http://www.cnn.com/2016/11/09/politics/tom-cotton-waterboarding-torture/ There’s no room for heterogeneous thought in the Alex Jones World Order. It’s an order that will have the government harass you for merely wanting to escape its reign of terror.

Alex Jones recently invited everybody to analyze faux news. In this commentary, I take up his challenge. Here’s Alex trying to recruit thousands of fellow thought police:

VIDEO DELETED BY YOUTUBE

Alex spends time directing people’s anger towards Amy Schumer. Is Amy Schumer leaving the country? Isn’t she? Is Amy caught in a lie? It’s worse than tabloid politics because Amy Schumer isn’t even a politician. As Shakespeare said, be it thy course to busy giddy minds. This is distracting people with quarrels over transitory issues of little or no significance. Alex then talks about his favorite bogeyman – the abstraction called “globalism”. Waging a war on “globalism” will be as endless as is the war on “terrorism”. It’s all platitudes. While it’s true there are institutions of global governance that should be dismantled, President Obama’s warning against a “crude sort of nationalism” isn’t without merit. Opposing nationalism in no way implies support for “globalism”, nor does it validate anything Alex says. There’s nothing wrong with market globalism. As Frederic Bastiat said, if goods don’t cross borders, armies will.

Pursuant to Infowars, Ron Paul has even published a “hit list”. Yes. A “hit list” of people in the mainstream news. See: http://www.infowars.com/ron-paul-reveals-hit-list-of-alleged-fake-news-journalists/ Alex spoke very approvingly of the “hit list” in yesterday’s show. Does anybody know what a “hit list” means? To be clear, I’m not here to publish “hit lists”. I’m here to deconstruct faux news. Gentle reader, I couldn’t imagine what would happen to me if I published “hit lists”. Or what would be said about me if I endorsed the “hit list”? If I failed to do anything other than condemn it, as I do? Even condemning it will get me in trouble with somebody.

From a few days ago, here’s Alex Jones covering Steve Bannon’s recent interview:

VIDEO DELETED BY YOUTUBE (NOTE: I FOUND THIS VIDEO IS ARCHIVED RIGHT HERE: http://web.archive.org/web/20190123103347if_/https://www.youtube.com/embed/VQoh0ybEVc8?feature=oembed)

This one clip alone of Alex should be sufficient to convince his most die-hard followers to do an about face. It’s a museum-quality piece. There’s an emergency, alright. Alex has gone completely off the deep end. Alex’s coverage is very peculiar. He excises some of the most consequential information. It becomes self-evident that Alex amalgamates germs of truth with lies, contorts and omits truth, in order to smuggle lies past his audience. The Alex Jones sashay: ignore the consequential while dwelling on the inconsequential. Notice who Alex recommends people read. It’s not Henry Hazlitt or Ludwig von Mises.

Here’s one huge gem that Alex conveniently excises from at least two days worth of interview coverage:

“Like [Andrew] Jackson’s populism, we’re going to build an entirely new political movement,” Bannon says. “It’s everything related to jobs. The conservatives are going to go crazy. I’m the guy pushing a trillion-dollar infrastructure plan. With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything. Ship yards, iron works, get them all jacked up. We’re just going to throw it up against the wall and see if it sticks. It will be as exciting as the 1930s, greater than the Reagan revolution — conservatives, plus populists, in an economic nationalist movement.” See: http://www.breitbart.com/big-government/2016/11/18/steve-bannon-vows-economic-nationalist-movement-white-house-exciting-1930s-greater-reagan-revolution/

Alex Jones and Donald Trump inform us that China – not the government in Washington – is the biggest “abuser” of the United States. Pursuant to Jones and Trump, the most devastating weapon China has in its arsenal is currency manipulation. In other words, pursuant to the protectionists, renminbi devaluation is tantamount to an attack on the United States. But are the protectionists right? Is the Sinophobia justified? Do they not understand that interest rates are artificial? Are Jones’s ideas anything but a menace to the national security of the United States?

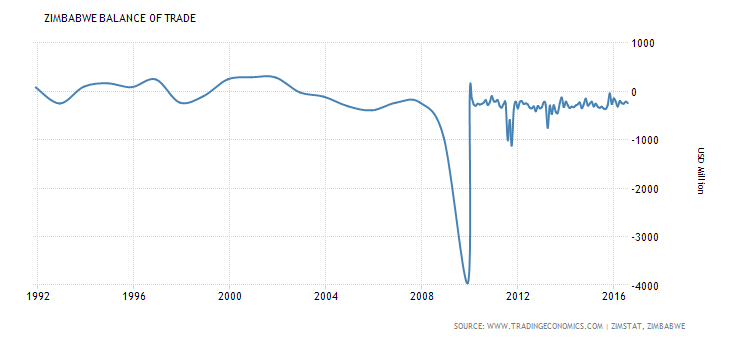

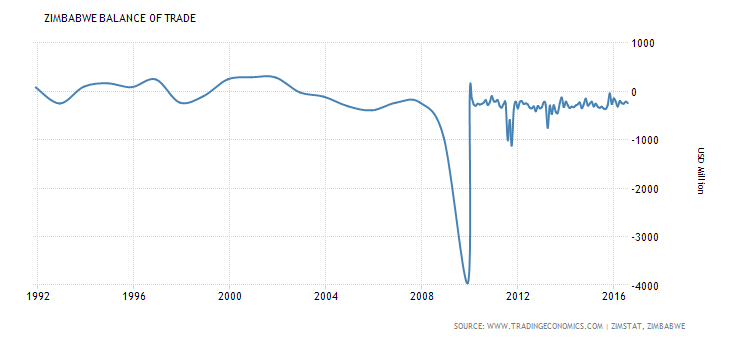

Prevailing practitioners of economics tell us that inflation stimulates exports. They get the flow of capital inverted. Otherwise, pray tell, why wouldn’t Zimbabwe be the world’s leading exporter? Inflation inflicts injury upon the manufacturing base, engendering capital outflow and the destruction of jobs.

Not only has Zimbabwe not been the world’s leading exporter, below is a chart that shows what happens to the balance of trade in juxtaposition with inflation.

Contrary to prevailing economic orthodoxy, inflation is not export-friendly. Inflation nurtures dependence upon cheaper foreign markets to supply us with production (i.e. begets capital outflow). Capital outflow can be reversed by compelling the Fed to tighten. If the Fed tightens, interest rates rise, prices collapse to reflect wages, the market clears (only then does the economic recovery begin), and dollars that have accumulated in foreign reserves will coming flowing back into the domestic loan market, thus lowering the natural rate of interest. Anything that nurtures sticky prices and/or wages will prevent the market from clearing.

“The dollar rose against most major currencies on Thursday as a latest report showed U.S. trade deficit plunged in February,” pursuant to one news source.[1]

“The contraction in the deficit came with a big recession-driven fall in imports and an unexpected rebound in exports, the Commerce Department said overnight in the US,” pursuant to another news source.[2]

In July of 2008, the dollar went through a rally – albeit a pseudo-rally – marked by falling nominal prices. Although falling nominal prices is not deflation (i.e. the contraction of the money supply, which would be a healthy thing), that’s the definition of deflation pursuant to prevailing orthodoxy. When the dollar rally began, the trade deficit declined, due to both decreasing imports and increasing exports. In other words: the fall in the trade deficit had been accompanied by a dollar rally. What prevailing economic orthodoxy teaches regarding inflation’s impact on capital flows betrays this possibility.

In November of 2007, Ben Bernanke put on an exhibition of his confusion when he said that inflation is inconsequential for everything but imports.[3] He literally said that dollar devaluation raises prices of everything not denominated in dollars! As if the Fed creating inflation has nothing to do with bond prices. Apparently, Bernanke was blinded by prevailing orthodoxy, which tells us that inflation mitigates a negative balance of trade – another Keynesian apologia for inflation that needs to be buried.

On a peripheral note, Bernanke’s argument runs slightly afoul of prevailing orthodoxy. Prevailing orthodoxy tells us that inflation does raise prices for Americans, and that this magically lowers real prices for foreigners. If Bernanke can’t figure out that increasing the supply of dollars raises dollar-denominated prices, then the average person is hopeless for understanding the international trade cycle and how capital flows.

The decline in imports and rise in exports in juxtaposition with the short-lived dollar rally were not a fluke, nor is this inexplicable. The trade “deficit” is but a symptom of monetary policy. A trade “deficit” isn’t bad per se. A trade “deficit” between two countries is no worse than a trade “deficit” between two towns. The consequential part is if the trade “deficit” is due to something other than comparative advantage (e.g. inflation).

“Suppose four-fifths of all the money in GREAT BRITAIN to be annihilated in one night, and the nation reduced to the same condition, with regard to specie, as in the reigns of the HARRYS and EDWARDS, what would be the consequence? Must not the price of all labour and commodities sink in proportion, and every thing be sold as cheap as they were in those ages? What nation could then dispute with us in any foreign market, or pretend to navigate or to sell manufactures at the same price, which to us would afford sufficient profit? In how little time, therefore, must this bring back the money which we had lost, and raise us to the level of all the neighbouring nations? Where, after we have arrived, we immediately lose the advantage of the cheapness of labour and commodities; and the farther flowing in of money is stopped by our fulness and repletion.

“Again, suppose, that all the money of GREAT BRITAIN were multiplied fivefold in a night, must not the contrary effect follow? Must not all labour and commodities rise to such an exorbitant height, that no neighbouring nations could afford to buy from us; while their commodities, on the other hand, became comparatively so cheap, that, in spite of all the laws which could be formed, they would be run in upon us, and our money flow out; till we fall to a level with foreigners, and lose that great superiority of riches, which had laid us under such disadvantages?” -David Hume, Essays, Moral, Political, and Literary, 1752

What mainstream economists teach runs contrary to what David Hume taught us in 1752. Hume describes arbitrage. Prevailing economic orthodoxy inverts the international trade cycle. We are told that inflation mitigates the trade “deficit”. By inflating the money supply, dollars will become less attractive to foreigners. Thus, runs the argument, foreigners will follow by curtailing exports to the U.S. Somehow, domestic productivity will magically be increased, stimulating exports.

The genesis of this error is begotten by the underlying macroeconomic assumptions. Rather than using microeconomic principles to understand macroeconomic phenomenon, mainstream economics fragments microeconomics and macroeconomics into separate compartments. Macroeconomics then becomes myopic, by lopping individuals out of its paradigm. Myopic macroeconomics doesn’t consider individuals; it only considers aggregates.

Translated, the macroeconomic analysis is this: the country has dollars. If the country, or nation – or whatever aggregate you wish to use – decides to print more dollars, the country, or nation, isn’t going to refuse to use its own dollars. However, the country, or nation, of, say, France, being a different country, won’t like very much the devalued American dollar.

I guess we aren’t supposed to ask why both inflation and the trade “deficit” have risen in juxtaposition with one another. Sound economics gives us that answer. If inflation did mitigate a trade “deficit”, then one is boxed into the position of currency-devaluation wars. Inflation vs. counter-inflation vs. hyperinflation.

The economy is made up of individuals making choices in exchanges. When the government devalues the currency, this doesn’t only make dollars less attractive to individuals abroad, but also to individuals right here at home. This is reflected with higher prices. It isn’t about aggregates printing more money for use by aggregates.

Inflation (i.e. the creation of money ex nihilo) disconnects sustenance from the satisfaction of consumer demands, diminishing the need to set market clearing prices. Consequently, inflationary stimulus interferes with the price mechanism preventing prices from falling to reflect wages. The market fails to clear, thus derailing an economic recovery. With mass unemployment, the last thing that will rise will be wages. The domestic cost of production goes up. Thus, to reduce costs, capital flight takes place. Inflation actually increases the dependence upon cheaper foreign markets to supply us with production.

As David Hume saliently articulated in 1752, inflation makes not only the currency less attractive abroad, but also the higher-priced goods. It also makes the higher-priced goods less attractive right here at home. Using inflation to remedy a trade “deficit” is akin to breaking a leg to make yourself more competitive.

The short-lived – due to central bank intervention – dollar rally in 2008 was not the consequence of the declining trade deficit; it was the cause of the declining trade deficit. Everything denominated in dollars becomes cheaper. It shouldn’t take a genius to figure out that one doesn’t become more competitive by raising prices.

It’s impossible to devalue the dollar to manipulate exchange rates without impacting any other prices. It might be true that devaluing the dollar will enable renminbi holders to purchase a greater quantity of dollars, but it will require a greater quantity of dollars to purchase goods and services. Therefore, real prices haven’t been lowered for renminbi holders whatsoever.

If inflation actually mitigated a trade deficit, Zimbabwe would be one of the world’s leading exporters. Inflation doesn’t lower real prices for anybody. But even if inflation did mitigate a trade deficit by lowering real prices for foreigners, while making things more expensive for Americans, why would that be a good thing? Why should American economic policy be calculated to make things cheaper for foreigners and more expensive for Americans? Economic growth – which is not measured by the GDP – engenders falling prices, which is a good thing.

Inflationary stimulus has served one purpose: preventing prices from falling to reflect wages. The market then fails to clear. The real issue isn’t even the direction of nominal prices, but what prices would otherwise be absent central bank manipulation. Even if prices fall in nominal terms while wages fall much faster, then we’re still suffering from the consequences of inflation. We can be suffering from lost price deflation. Falling nominal prices engender rising real wages.

Inflationary policy by the FOMC suppresses nominal interest rates by increasing the supply of loanable funds, but without a genuine expansion of savings to fund investment. Investment can only come out of savings since producers must be able to consume in order to sustain the process of production. Deploying printing-press money (i.e. unearned income) transfers money away from producers and the process of production to consumers. Inflationary stimulus disconnects consumption from production, turning Say’s law upside down. Thus inflation not only drives capital overseas, but begets capital consumption. Inflation is injurious to the process of production.

Interest rates are more than the cost of money. The essence of a credit transaction is the exchange of present wealth for future wealth. Interest rates are the discount rate of future goods against present goods. That present goods are more valuable than are future goods is why machinery doesn’t get bid up to what it will net. It doesn’t make economic sense to spend $2,000 on a vending machine that will net $2,000 over its lifespan throughout several years. The market’s discounting of machinery and equipment based upon future returns is called originary interest.

Increasing the money supply tricks the loan market into consummating unjustifiable loans to non-credit worthy projects. That’s why malinvestment occurs and projects are halted midstream with the revelation of malinvestment. By allowing debtors to pay back creditors with devalued dollars, real interest rates are suppressed. There’s no right way for the loan market to extend credit at negative real rates, which is a negative ROR in real terms. That’s a calculus for the loan market to go bust as it did in 2008. See: http://www.federalreserve.gov/releases/h3/hist/h3hist1.htm [now the information must be downloaded]. Check out the early months of 2008. That’s not psychological and that’s not a matter of consumer confidence.

The long end of the curve is most sensitive to market forces while the short end of the curve is most sensitive to FOMC policy. If the Fed stays loose to prop up the bond market, this will undermine the very bond market the Fed is trying to prop up. Investors/lenders will account for the inflation risk by tacking an inflation agio onto the curve. Eventually, the Fed will lose control over the short end, too. Under the scenario where the Fed stays loose, there will be no floor underneath the dollar nor any roof on interest rates.

Already, central banks seem to be the only buyers for mispriced bonds. As the Fed stays loose to prop up the bond market, this undermines the bond market in real terms, since other asset classes rise much faster.

Under the scenario where the Fed props up the bond market indefinitely, both the bond market and the dollar collapse. Dollars will hit parity with bonds. The Fed will be left with $18.5 trillion plus – in nominal terms – worth of bonds on its balance sheet, and we will be left with both junk bonds and junk dollars. The dollar itself will go bankrupt. What should be the true par value (i.e. redemption value) of bonds? We don’t know, because the Fed has been propping up the bond market.

Under the scenario where the Fed tightens, the bond market will decline in nominal terms, but the dollar will be saved and what’s left of real bond values will be salvaged. Dollars won’t hit parity with bonds. Just like investors/lenders tack an inflation agio onto nominal rates, there could very well be a deflation agio. Nominal interest rates could be set very low with the real rate of return coming from an increase in the purchasing power of the dollar. The only way to save the dollar is to stop propping up the bond market.

Until the Fed is compelled to tighten, we won’t have an economic recovery. The loan market has to set interest rates pursuant to the true supply of savings. If interest rates were to hit, say, ten percent on the two-year with a $18.5 trillion national debt, do the math. The longer interest rates are artificially suppressed, the higher they will have to go in order to correct the imbalances in the economy.

By tightening sooner rather than later, this will not only allow the market to discover the natural rate of interest by letting interest rates rise, this will encourage capital inflow. Capital naturally gravitates towards cheaper, higher-yielding, more efficient economies. It’s called arbitrage. The Fed is waging an eternal struggle against arbitrage. The Fed, through its war on low prices, has made the United States more expensive and lower-yielding.

If a person, firm, or institution is dependent upon inflationary credit expansion for sustenance, that person, firm, or institution is – by definition – insolvent. Somebody or some institution (e.g. government) is spending beyond their/its means. As a nation, we have spent beyond our means. Expenditures exceed earnings and we depend on foreign markets to supply us with production. We don’t suffer from a dollar shortage, but from a dollar leakage.

Inflation is no substitute for income-generating investment. Inflation creates pseudo prices and pseudo rates of return. Presently, there’s no right way to invest in the U.S. economy. It’s error to conflate trading with investing. Buying and selling real estate is not investing. Buying and selling equities is not investing. I’ll draw the distinction between trading and investing. A trader buys and sells a particular asset based on nominal price movements. An investor buys and holds a particular asset based on returns from the underlying asset itself. In the case of real estate, that would be rents. In the case of equities, that would be dividends.

The problem isn’t a lack of regulatory oversight. One can’t regulate away past mistakes. Insolvency can’t be regulated away. The only solution is to force up interest rates, prices fall, dollars that have accumulated in foreign reserves will flow back into the domestic loan market, which will then beget a lower natural rate of interest. Any other solution will lead to the destruction of the currency, in which case everybody’s savings get wiped out. Loose monetary policy to prop up a spending orgy engenders capital outflow (i.e. begets outsourcing).

Inflation is a tax. There’s no objective difference between the government taking the money you have in your pocket and duplicating the money you have in your pocket, thus devaluing the purchasing power of what you have in your pocket. Even if prices don’t rise in nominal terms, the real issue is what prices would otherwise be absent central bank manipulation.

Furthermore, if one is going to hold the position that rising prices is synonymous with economic growth, then they’re boxed into advocating skyrocketing prices in order to have fast economic growth. The way to have fast economic growth under such a scenario would be to have prices rise fast. I believe there’s a term for that. It’s called hyperinflation. Who supports hyperinflation?

The only path to an economic recovery runs through monetary tightening by the Fed. Waiting until we have an economic recovery before tightening is a calculus to destroy the currency and the economy. When the currency collapses is impossible to predict, but the currency will eventually collapse if current policies aren’t abandoned. We can prevent this if we change policy. Absent dealing with monetary policy, no politician offers us an economic solution. Forcing up interest rates means Washington relinquishing power. If Donald Trump can get away with talking about China’s management of the renminbi, there’s no reason why discussing the Fed’s management of the dollar should be taboo.

By buying dollars, China has helped postpone the day of reckoning. Having the Fed stay loose and asking China to buy dollars in perpetuity is like asking China to commit national harakiri. Renminbi devaluation would actually be injurious to Chinese exporters. If China really wanted to give herself an advantage, she would cease inflating and decouple from the dollar. Our real economic adversary is not in Beijing, but in Washington. Blaming China for our own failing policies is misguided at best. The solution is to abandon our own failing policies.

Objectively, the protectionist complaint about jobs “going” to China and China “cheating” on trade can be reduced down to there’s a problem with China buying dollars. How, pray tell, are jobs “going” to China other than the fact that dollars are going to China? How and why, pray tell, do dollars go to China? The tea party looks to be Bushism plus protectionism, which actually makes Bushism look very appealing.

Jones and Trump say nothing about dollar devaluation. From what I can tell, they want the Fed to stay loose, but they don’t want China to buy dollars. Having the Fed stay loose in juxtaposition with protectionism is very dangerous. They are ignoring the underlying problem while advocating more intervention to try to mitigate the symptoms.

Let’s pretend Jones and Trump are both honest persons and are genuinely confused, rather than dishonest. Confusion begets error, and error begets error. As I’ve articulated, Jones and Trump invert the flow of capital. It seems like that might be the genesis of their error.

Prevailing economic orthodoxy tells us that dollar devaluation is good for exports. But it’s impossible to devalue the dollar to manipulate exchange rates without impacting any other prices. It might be true that devaluing the dollar will enable renminbi holders to purchase a greater quantity of dollars, but it will require a greater quantity of dollars to purchase goods and services in the United States. Therefore, real prices haven’t been lowered for renminbi holders whatsoever.

Now let’s switch around dollar and renminbi holders. It might be true that devaluaing the renminbi will enable dollar holders to purchase a greater quantity of renminbis, but it will require a greater quantity of renminbis to purchase goods and services in China. Therefore, real prices haven’t been lowered for dollar holders whatsoever.

Suppose the PBC stays tight while the Fed stays loose. That would create even more lopsided arbitrage opportunities, in which case capital will flee to China at an accelerated pace. The old axiom about buying low and selling high is true, except in the world of central banking and the bond market. Do we really expect China to buy dollars while the Fed stays loose in perpetuity? Far from China being an adversary, China has helped postpone the day of reckoning by buying dollars.

Suppose the PBC loosens. Far from giving Chinese exporters an advantage, it would actually give Chinese exporters a disadvantage. If the Fed stays loose, China’s best course of action for its own national interests would be to tighten and decouple from the dollar – not unpeg, but decouple. Should Washington have the exclusive right to “print” the world’s “gold”? Why would China permit this in perpetuity? The one advantage that Washington has is that no government on earth wishes to abide by the discipline of a gold standard.

Renegotiating trade deals – as bad as some of them are – won’t repatriate capital. China’s loose monetary policy is not what “takes” our jobs. It’s Washington’s loose monetary policy. Capital naturally gravitates to cheaper, higher-yielding economies. It’s called arbitrage. If China tightened, becoming cheaper, that would precipitate capital outflow to China.

The idea that we can repatriate capital by adjusting nominal tax rates in juxtaposition with the Fed staying loose is a delusion. Does scapegoating China for our economic problems make it more or less likely we can attract Chinese capital? If the desire is to repatriate capital, then Jones should be demanding the Fed tighten and force up interest rates. When the Fed ceases inflating, we are back on a gold standard, because the only new money would be created through mining (i.e. a market transaction). There’s no need to make the dollar convertible, nor would making the dollar convertible be desirable, since that would be a price control like any other.

Imposing further regulations, restrictions, and capital controls as a makeshift effort to remedy capital outflow is a dangerous prescription that will result in economic dislocations. We need a plan to repatriate capital, not trap in capital. No plan to repatriate capital has been offered. Let no amount of patriotic sloganeering disguise protectionism as anything other than corporatism. It’s not about protecting jobs, but restricting access to cheaper markets for the non-politically-connected. If we reject the laissez-faire arguments against capital controls today, the resulting chaos will be met with demands for tighter controls tomorrow. I’m compelled to conclude that Jones’s ideas are a menace to the national security of the United States.

Back to faux news. Bad ideas pose no threat except when welded with state power, which can be diminished vis-à-vis monetary tightening. The solution to faux news is not censorship. The solution is more speech. Truth exposes Alex. Is Infowars faux news? I’m not here to play defense for the mainstream media, but I can’t possibly think of Infowars as a credible news source. Not only was Prince murdered by illuminati music executives, he was also killed by chemtrails. See: http://www.infowars.com/special-report-was-prince-murdered-by-illuminati-record-execs/ and http://www.infowars.com/did-the-chemtrail-flu-kill-prince/ We don’t need censorship. We need monetary tightening. The wonderful thing is here’s empirical evidence enough to convince the most recalcitrant central planners of the urgent need for monetary tightening. Loose monetary policy has adversely impacted Infowars, as there appears to be an Infowars bubble. At the very least, perhaps we can nationalize Infowars and make it non-profit, to then dismantle the operation. Remember, Alex indicts the Fed not for creating inflation, but for being a “private, for profit” enterprise.

[1] – http://news.xinhuanet.com/english/2009-04/10/content_11160595.htm

[2] – http://www.theaustralian.com.au/business/us-trade-deficit-dive-may-ease-slide/story-e6frg8zx-1225697017588

[3] – http://www.youtube.com/watch?v=nj9KHJRRUbQ – The consequential portion of the video is around the 5-minute mark. Inflation is not rising prices. To say so implies that rising prices are caused by rising prices. That contorts Irving Fisher’s own Quantity Theory of Money. Rising prices are the consequence of inflation, which is an expansion of the supply of money not redeemable in a fixed amount of specie. Prices could drop in nominal terms, yet prices could be too high in real terms. Falling nominal prices engenders rising real wages. We can still be suffering from inflation due to contortions in the price mechanism since prices remain higher than what they otherwise would be absent central bank policy.