Just a few weeks ago something really occurred to me. I’m a staunch supporter of free markets, precisely because I care about our country and its inhabitants. For me, it definitely impacts how I strive to live. I don’t support free markets because I hate. I support free markets because I love. I strive to not judge anybody for disagreement over ideas. What occurred to me just recently was how under the current system, the entire federal government, all state and local governments, could be jettisoned, and that would result in nothing close to a free market. Why? It all goes back to the monetary and financial system, which isn’t based on a free market. Sure. We could jettison all government. And what would the result be? We have the uber wealthy elites like Bill Gates and Elon Musk running around with unchecked power. Jettisoning government would result in a loss of checks and balances. Also, anybody who tries to single out some agency or department, like the FBI, as if the FBI is the only corrupt entity, is a demagogue, not a true supporter of free markets. In fact, under the current system, probably the last entity I would start would jettisoning would be the FBI.

Authors

Embrace the free market for cleanest energy

Whenever I see somebody advocating the government promote “clean energy,” I’m reminded of a plea from a congressman I saw many years ago encouraging people to report price gouging at the gasoline pump. If somebody saw a gasoline price that deviated upwards from some “normal,” they were encouraged to report it to some hotline. Simultaneously, there are regional committees that enforce regulations against undercutting on the price of gasoline. In other words, the real purpose of the central planners was to enforce the same price.

There’s only one reason to set similar prices amongst vendors, and that’s not to curtail price gouging, but to fix prices upwards. The market will punish price gouging naturally, driving gougers out of business. How so? If a vendor is selling gasoline 5 or 10 cents higher than other gas stations, that vendor will lose market share to other vendors. If somebody sees higher prices on the same gasoline, don’t call a hotline. Buy the cheaper gasoline. Furthermore, how do we know what vendors are price gouging and what vendors are undercutting? If half the stations have a price that’s lower than the other half, is one half price gouging or is one half undercutting?

That price gougers can’t succeed in the free market is why cartels must rely upon government intervention and support. All participants must raise prices in synchronization with one another. The moment one participant begins to set prices pursuant to supply vs. demand, the entire cartel begins to collapse. The problem for the cartel is that even if all participants set prices pursuant to the price-fixing scheme, vendors can’t short inventory at prices above what consumers are both willing and able to pay. Higher prices beget fewer consumers, diminishing the volume of sales.

The campaign against fossil fuels has nothing to do with saving the environment. It’s all about price-fixing by erecting barriers for oil producers that benefit the big oil producers and big “green” energy companies that can’t compete against fossil fuels. It’s about the restraint of trade to curtail competition. Not only is it about price-fixing, it’s about waging war against humanity. Restricting the supply of energy is most injurious to the poor. On one hand, the government offers subsidies to people with low income. On the other hand, the government pursues policies that raise the cost of living.

The key to an economic recovery does not rest in Washington. The key to an economic recovery is to put Washington through a recession. Any efforts by politicians to con you into believing they’re stimulating some kind of economic progress — again, bribing you with your own money — by promoting one form of energy or another should be detected as a ruse.

Some politicians have gone “green” in the name of curtailing “dependence on fossil fuels” and “foreign oil.” It’s a sham. Why not promote a certain type of underwear in the name of curtailing dependence on a particular foreign brand?

The fundamental problem is that most politicians and central planners view the economy as a blob to be manipulated, rather than a complex capital structure involving individuals making choices in exchanges, a process of production, and a price mechanism.

Last year, the United States imported about 2.3 million barrels of oil per day more than it exported. The reason why the United States is so dependent upon foreign oil is due to policies that have already been put in place. The solution, then, is to repeal and correct these policies — not creating new legislation.

Artificially low interest rates, brought on by loose monetary policy at the FOMC, drives capital overseas (by deploying unearned income from a printing press, disconnecting consumption from production, capital is also consumed). Capital naturally gravitates to cheaper, more efficient, higher-yield economies. It’s called arbitrage. Rather than generating revenue and income, the nation spends beyond its means. That’s the short explanation. I hate to spend time belaboring the long answer, because I have already done so in previous commentaries.

Look at it like this: If a person, firm, or nation is dependent upon inflationary credit expansion, then that person, firm, or nation is insolvent and inefficient. We are spending beyond our means, which — yes — engenders dependence upon cheaper markets to supply us with production.

If you want to reduce dependence upon foreign “anything,” then the Fed has to tighten, forcing up interest rates, and Washington has to abandon the spending orgy. Dollars that have been accumulating in foreign reserves will then come flowing back into the domestic loan market, begetting lower interest rates.

It’s impossible for any industry — including clean energy — to thrive in the absence of sound economic policy. Rather than promoting one form of energy or another, the best thing the government can do to buttress clean energy would be to pursue free-market policies which extend the maximum number of benefits for the maximum number of people. It’s impossible for a government to bankrupt a people and keep industry intact.

I know clean energy sounds so nice, so questioning it is very environmentally incorrect. I will put everything I can into layman’s terms. Let’s start with the following axiom: We consume energy in everything we do. If you’re that environmentally conscious, you shouldn’t be online reading this right now because you’re using electricity which is consuming energy. That’s why I’m confident that everybody reading this agrees with everything I write in this commentary.

Solar energy sounds so nice. After all, it comes from the sun. But let’s not forget that there is a process of production. Take, for example, the solarization of a house. Solar energy requires panels, charge controllers, batteries, inverters, etc. And then let’s not forget capital asset depreciation. Energy is consumed during the process of production.

If clean energy has a positive yield, then it is profitable and private enterprise will pony up the capital. The government need not encourage this. If clean energy has a negative yield, then it is unprofitable and would be dependent on so-called “dirty energy” for its sustenance. It would be akin to consuming 1,000 blueberries for every 500 you are growing — nobody in their right mind would pursue that course absent government subsidies. Somewhere, the difference has to be made up.

I’m not arguing that solar power is necessarily inefficient, but that the market will naturally produce the most efficient, and therefore the cleanest, forms of energy. It’s the pursuit of profits on the free market that engenders efficiency. It’s government intervention in the marketplace that engenders inefficiency and the needless consumption of resources. Government subsidies enable firms to produce inefficient energy. By mandating inefficiency, only those with political connections can compete. Conversely, sound economic policies enable firms to supply efficient forms of alternative energy absent government support.

This leads me to the following axiom: The most profitable and economically-efficient form of energy, within the construct of the unhampered market, is also the cleanest form of energy. Also, pretending that climate change is real, does this mean we should rely upon government coercion to solve the problem? Cancer is real, but that doesn’t mean we should trust the government to run our healthcare. Rather than saying end our dependence on oil, if you support clean energy then you should be saying end our dependence on government intervention in the marketplace.

The best ecological hygienist is the unhampered market. Suppose a logging company owns a forest. That logging company can clear-cut the forest, say, tripling immediate income. However, this must be weighed against diminishing future income, or the capital value of the forest as a whole. Suppose, however, this is government property. This calculation no longer needs to be made, and the objective is going to be rapid extraction of resources. Private property rights engender environmental stewardship.

No shocker, then, that government is the biggest abuser of the environment and waster of resources. Look at the atomic weapons tests done in the Nevada desert — and right on top of our own military service members. Or think about the government’s war policy, which both major parties support. Last time I checked, there are no CAFE standards on tanks. How are exploding munitions good for the environment? Have politicians seriously considered the environmental impact of their foreign policy?

The government does not sustain itself by satisfying consumer demands, but through compulsory taxation. Government subsidies to, and control over, industry diminishes the need to set prices pursuant to supply vs. demand. Why? Because sustenance is no longer nexused with having to satisfy consumer demands. Sustenance is disconnected from the satisfaction of consumer demands.

It’s the price mechanism that ensures resources are allocated and managed efficiently. The price mechanism can only function within the construct of the unhampered market, allowing for producers to set prices pursuant to supply vs. demand (i.e. market-clearing prices). The scarcer the supply, the greater the demand, the higher the price. Consumption runs inversely with prices.

Government subsidies distort prices, interfering with the price mechanism, and cause prices to be set above, or below, market-clearing prices. There is a paradox in government policy in that the government encourages consumption without production (in the name of demand-side stimulus), tells us that we should conserve resources, while simultaneously punishing “price gouging.” Within the construct of the unhampered market, there can’t be price gouging any more than there can be wage gouging, since vendors can only short inventory at prices consumers are both willing and able to pay.

Prices send signals to entrepreneurs, telling them where to deploy capital. Prices tell entrepreneurs what to produce and what not to produce. Prices tell consumers what to buy and what not to buy. The price mechanism can only function within the construct of an unhampered market. There’s no need for the government to encourage or discourage the use of any kind of energy. And let’s not forget that tax credits are subsidies camouflaged as tax cuts. A tax credit merely allows a person to use a portion of their income for a specific purpose (i.e. indirect subsidy).

I write as a native Minnesotan. Minnesota is one of the states that mandated the use of ethanol-blend fuels. I hate ethanol-blend fuel. It’s “cheap” for a reason: It’s inefficient. There are environmental groups pointing out that the production of biofuels is a drag on the environment.

Only politicians can get away with turning efficient food into inefficient fuel. If politicians keep at it, we will soon be filling our automobiles up with corn and drinking motor oil. Maybe after installing those solar panels, the government can begin shooting those pollution particles — which supposedly ”clean energy” is designed to curtail — into the atmosphere in order to block the sun and “save” us from “global warming.” Sounds like the perfect plan – one only a politician in Washington can dream up.

As I wrote over a decade ago, we will soon not only be dependent upon foreign sources of fossil fuels, but also foreign sources of so-called clean energy. That has come to pass. Unfortunately, it was due to misguided policies coming from Washington. If people truly cared about the environment, they would embrace the free market.

The menace of right-wing socialism

Once upon a time, I chauffeured Pat Buchanan. Around the same time, I even listened to right-wing talk show host Alex Jones. This is going back around 18 years ago for both. I say this to help readers understand that I don’t write as a left-wing Democrat. As I took time to actually learn and understand economics starting in the year 2000, I equipped myself to discern fact from fallacy. Today, I see the right wing promoting a plurality of dangerous fallacies. I never thought I would have to sit here believing that the biggest menace we now face is right-wing socialism.

On one hand, President Trump and the right wing are complaining about the actions of Fed head Jerome Powell. Why? Because the Fed is tightening. From a free-market, Austrian-school perspective, Jerome Powell and the Fed are doing the right thing. Yet, the right wing is agitating for quantitative easing in perpetuity. On the other hand, President Trump and the right wing are agitating for bigger government to impose trade and immigration controls, and build a border wall.

Pursuing an uber-loose monetary policy in juxtaposition with tighter trade and border controls is about the worst of all combinations. The case I make is that if we solved our economic problems through sound policy, settled would be the symptoms of bad policy like job losses and trade deficits that the right wing is trying to remedy through bigger government.

When one understands how capital flows, it becomes much easier to see the absurdity of Trump trying to remedy the trade deficit through tighter trade controls while simultaneously agitating for a promiscuous Fed. David Hume taught us how capital flows in 1752:

“Suppose four-fifths of all the money in GREAT BRITAIN to be annihilated in one night, and the nation reduced to the same condition, with regard to specie, as in the reigns of the HARRYS and EDWARDS, what would be the consequence? Must not the price of all labour and commodities sink in proportion, and every thing be sold as cheap as they were in those ages? What nation could then dispute with us in any foreign market, or pretend to navigate or to sell manufactures at the same price, which to us would afford sufficient profit? In how little time, therefore, must this bring back the money which we had lost, and raise us to the level of all the neighbouring nations? Where, after we have arrived, we immediately lose the advantage of the cheapness of labour and commodities; and the farther flowing in of money is stopped by our fulness and repletion.

“Again, suppose, that all the money of GREAT BRITAIN were multiplied fivefold in a night, must not the contrary effect follow? Must not all labour and commodities rise to such an exorbitant height, that no neighbouring nations could afford to buy from us; while their commodities, on the other hand, became comparatively so cheap, that, in spite of all the laws which could be formed, they would be run in upon us, and our money flow out; till we fall to a level with foreigners, and lose that great superiority of riches, which had laid us under such disadvantages?” —David Hume, “Essays, Moral, Political, and Literary,” 1752

What David Hume describes in this superb passage is called arbitrage. Some people have an inverted understanding of how capital flows, believing that inflation is good for exports. As Hume articulated, inflation makes not only the money less attractive abroad, but the higher-priced goods as well. It also makes the higher-priced goods less attractive right here at home. Using inflation to remedy a trade deficit is akin to breaking a leg to make yourself more competitive.

It should come as no surprise that inflation and the trade deficit have risen in juxtaposition with one another. With inflation comes higher costs. To reduce costs, capital flight takes place. Inflation nurtures dependence on cheaper foreign markets to supply us with production. Trade controls are not the solution. The problem isn’t that foreign markets are cheaper, but that the U.S. has been too expensive. Why? Because we’ve had an uber-loose Fed, which the right wing wants to continue on unabated. The only path to repatriating dollars and curtailing capital outflow is Fed tightening. Attacking Jerome Powell and the Fed for making moves in the right direction is serious error.

The right wing platform is one of creating inflation, scapegoating immigrants for subsequent economic problems, and then trying to combat the effects of its own policies through tighter trade controls, which are objectively capital controls. In other words, pour on the money supply, blame immigrants and foreigners for our economic problems, and then restrict trade for Americans. That’s why I say what the right wing is agitating for is the worst of all combinations. There’s a synergy in having a promiscuous Fed in juxtaposition with tighter trade controls.

When President Trump was candidate Trump, he unveiled a plan to proscribe remittances sent to Mexico. Amazingly, remittances sent to Mexico were characterized by Trump as “de facto welfare.” Pursuant to the Trump calculus, money earned through productive work in the private sector is synonymous with welfare. By treating honestly earned money on the free market as “welfare” that the government can seize, this would discourage immigrants from performing honest and productive work. No matter where dollars earned flow, productive work is a benefit to the economy.

The purpose of Trump’s plan was to pressure the Mexican government into taxing its citizens in order to fund a border wall. In other words, Donald Trump has wanted to impose capital controls in order to get the Mexican government to pay for his cronies to build a border wall, which somehow isn’t considered to be welfare.

If Trump planned to impose capital controls in order to build a border wall, why believe a border wall wouldn’t be used to impose capital controls? With legislation like Foreign Account Tax Compliance Act that passed in 2010, why believe it would be used for anything other than trapping people and capital into the United States? Yet we were supposed to believe that Trump’s capital controls would have been used only against immigrants and until the Mexican government ponied up the capital to build a border wall, at which time Trump would cease being a menace.

Supposedly, Trump’s plan would have been limited to immigrants (somehow making it a good thing). Arbitrage has a funny way of holding lawless regimes in check. Desperate governments – like ones with a $22 trillion debt – do desperate things, and if we can justify curtailing capital outflow to Mexico in one instance, then why not in every instance? Why stop with just Mexico? Why not every other country?

I didn’t have to read about Trump’s plan to know that Trump would impose capital controls. The populist indictment of immigration is that immigrants “drive down wages.” Not true. This argument dovetails with arguments in favor of minimum wage law as an effort to fix wages. The welfare-warfare state drives down wages. The problem is not the immigration, but the welfare-warfare state. As I wrote in 2010, immigration restrictionism taken to its logical conclusion: capital controls.

Pursuant to the right wing, more immigration means more labor and consequently lower wages. On the surface, it sounds plausible. But sound economics informs us that more productive labor results in higher real wages for everybody. Objectively, the argument is that the way to boost wages is not by increasing, and removing impediments to, productivity, but by shrinking the labor pool. Yet, curtailing immigration to the U.S. does nothing to shrink the labor pool. The aggregate supply of labor remains intact, but in other countries.

The government could inflict injury upon every employer of Mexican immigrants (legal or illegal). However, this would do absolutely nothing to create or save a job. If employing inexpensive labor at home is curtailed, this begets one of two possibilities: the job is destroyed altogether, or the employer flees the country altogether.

What next? Criminalize capital flight? Pursuant to the statutory case against hiring illegal immigrants, the de jure case for capital controls is already in place. If it’s illegal to hire an illegal immigrant at home, then why is it legal to do business with “undocumented” workers abroad? (In that case, one becomes the de facto employer of foreigners living abroad.) For the sake of logical consistency, outsourcing should be criminalized. All international trade and commerce should be criminalized. If the government should proscribe remittances, then why not proscribe Americans from traveling to Mexico and paying Mexican nationals for goods and services?

An economic iron curtain, which the right wing clamors for, works both ways. Let me remind you that if the government can trap capital in, it can trap people in. Try leaving the country without your capital. If immigrants aren’t permitted to send money to Mexico, then how can they be expected to leave the United States? This means that Trump has, almost paradoxically, devised a scheme to trap immigrants into the country. Coming to the United States will be akin to checking into a roach motel. Furthermore, remittances to Mexico would curtail emigration from Mexico. This means curtailing remittances to Mexico would encourage emigration from Mexico.

Restricting the flow of people necessarily restricts the flow of capital, and vice versa. Immigration controls focus on the person, while trade controls focus on the capital, but both achieve the same undesirable results. Even if you believe Trump has the best of intentions and would never use the border wall to trap Americans in, who is to say his successors won’t?

We are being told that protectionism and capital controls are used to protect us, to protect our jobs. In reality, capital controls are a makeshift effort to remedy capital outflow engendered by loose monetary policy — not to mention a backdoor bailout of the U.S. banking system. Loose monetary policy not only drives up prices, but it drives down rates of return. Capital naturally gravitates to cheaper, higher-yield economies. It’s called arbitrage. This is why the earnings — and therefore the returns — are overseas.

The only way to repatriate capital is for the central bank to stop inflating, force up interest rates and return to sound money. If we pursued the right economic policies, people would voluntarily keep their money in the United States. If the government in Washington seeks to curtail capital flight, it must stop fixing prices and stop using the central bank to suppress interest rates. If Powell is getting anything wrong, it’s that the Fed isn’t raising rates aggressively enough. The policy of gradualism will only postpone the day we hit bottom, sidelining investors.

Not only will capital controls not work, capital controls will beget greater problems. If we reject the free market argument against capital controls today, then the resulting chaos will be met with demands for tighter controls tomorrow. Trump’s plan will morph the United States into an open-air prison. Trump’s plan will actually precipitate an exodus of capital.

To fix housing, less government intervention needed

Senator Catherine Cortez Masto is now saying that one of the biggest issues facing Nevadans is a lack of affordable housing. Senator Cortez Masto says that HUD Secretary Dr. Ben Carson isn’t doing enough to help create more affordable housing. See: https://www.rgj.com/story/news/politics/2018/03/27/masto-says-trump-appointee-carson-has-no-plan-help-nevadas-affordable-housing-crisis/464506002/ But is Senator Cortez Masto’s indictment legitimate?

“The art of economics consists in looking not merely at the immediate, but at the longer effects of any act or policy; it consists in tracing consequences of that not merely for one group, but for all groups.” -Henry Hazlitt

Far too often, politicians in Washington are plagued by myopia. Rising prices are not synonymous with economic growth, and falling prices are not synonymous with economic decline. Genuine economic growth tends to beget falling prices. Yet Senator Cortez Masto and her colleagues have supported government schemes to combat falling prices, i.e. price fixing. There’s a paradox in that politicians have sought to combat falling real estate prices while simultaneously complaining about a lack of affordable housing.

It’s the effort to prop up prices through stimulus that’s prevented the housing market from clearing. People have lost homes because homes are unaffordable, not because they are too cheap. Thus deflation is the cure, not the problem. What sense does it make to provide somebody with a cheaper mortgage — by interest rate manipulation through loose monetary policy at the FOMC — on a more expensive house that costs more to maintain? But that’s the aim of present policy. What sense does it make to stimulate more home building when housing isn’t clearing the market as is?

No matter which way the government inserts itself into the housing market, this diminishes the need for sellers to set prices pursuant to supply vs. demand (i.e. market-clearing prices). Whether the government buys up bad mortgages, bails out the homeowner or the bank, this interferes with the price mechanism. If we continue down the current policy path, one will have to be politically connected to get an “education,” a job, healthcare, and a house!

Suppose there’s a shop owner whose inventory is piling up because nobody can afford to pay for his prices. What does the shop owner have to do? Lower prices. But suppose the government inserts itself into the picture and subsidizes the shop owner. No longer is the shop owner’s sustenance dependent upon having to satisfy consumer demands, thus diminishing the need to set market-clearing prices. Within the construct of the unhampered free market there can’t be price gouging any more than there can be wage gouging, since vendors can’t short inventory at prices above what consumers are both willing and able to pay.

Let’s try another scenario. Suppose the government distributed “credits” or “vouchers” to this shop owner’s customers. This would be perceived as an “enlightened” form of welfare for the shop owner’s customers. However, this is yet a different way to subsidize the shop owner, by letting the shop owner sell at artificially high prices. A move like this prices the poorer non-recipients of “credits” or “vouchers” out of the marketplace. No surprise that education and healthcare — two of the most government subsidized cartels — have also had the highest levels of price inflation. This begets the erroneous perception that the problem is a dollar shortage for the one who didn’t receive “stimulus.”

It’s the subsidies and stimulus that have priced the poor out of the marketplace. Rather than understanding that it’s the “help” that has hurt us, the mistaken conclusion is that we need more subsidies and stimulus.

I’ve always said that, by rights, the impoverished belong to the free market movement. With the government as large as it is today, would it not be a fair assumption that many people who are poor are so precisely due to big government, whereas many people who are wealthy are so precisely due to big government? You see, big business uses big government to manipulate the marketplace on its behalf.

The flawed assumption made by some progressives is that big government is somehow less dangerous than big business. This begets the erroneous conclusion that the problem is an absence of regulation. It’s paramount to understand that we can’t regulate away insolvency. We can’t regulate away past mistakes. But we can regulate everybody except the big cartels out of existence.

Ludwig von Mises and Eugen von Bohm-Bawerk saliently articulated how labor can’t increase its share at the expense of capital. Nobody can argue against capital without arguing for a reduction in their own standard of living. Thus the problem for the progressive should not be with capital, per se, but that capital is so inaccessible to the common person.

Why is capital so inaccessible to the common person? Every tax, every regulation, every government program drives up the cost of capital. Politicians love this, because they get power. Big business loves this, because it creates barriers to competition. Big government creates monopolies, as a monopoly is a state of imperfect competition, and imperfect competition is begotten by government interference in the marketplace.

The situation with housing is no different than that of the shop owner I described above. In a market unhampered by government, sellers are sustained by selling inventory. When the government inserts itself into the picture, sellers are no longer dependent upon having to satisfy consumer demands by selling inventory. Sustenance is disconnected from the satisfaction of consumer demands. In the case of housing, the government and the Fed have subsidized the loan market to hold back inventory. See: https://www.sfgate.com/realestate/article/Banks-aren-t-reselling-many-foreclosed-homes-3165431.php

Simultaneously people are living in tents. The mission of politicians in Washington is literally to keep people homeless. Politicians are little more than kleptocrats masquerading as philanthropists. So long as the government keeps trying to prop up prices – as it has done with healthcare and education – housing will become increasingly unaffordable and the market won’t clear.

Anything that contributes to sticky prices and/or wages will prevent the market from clearing. Economic recovery rests upon a smooth-functioning price mechanism, where the market can discover real prices. How is Senator Cortez Masto or anybody else supposed to know what prices of everything are supposed to be? Would politicians mind telling me what housing prices are supposed to be? Should they be higher or lower? And if policy makers can’t answer this question, how can they possibly set sound policy?

DEBUNKING MYTHS & OFFERING THE SOLUTION

Myth: The problem is “toxic” assets (e.g. mortgage-backed securities) which have created systemic risk

When a hospital can’t collect payment, the hospital sells this debt to a collection agency. This doesn’t create booms and busts. The risk is asystemic unless the government bails out every debtor and/or creditor.

Myth: Present problems were caused by bad lending (i.e. sub-prime loans)

Promiscuous lending is a symptom — not a cause — of economic conditions. Take bad lending to its own logical conclusion: Creditors give away money as an act of charity, getting nothing in return. Does charity cause booms and busts? No. Promiscuous lending is a symptom of loose monetary policy at the Fed, which tricks the loan market into consummating unjustifiable loans.

It’s primarily through FOMC operations that interest rates are determined (until the Fed loses control, which will eventually happen). By expanding the money supply, this increases the supply of loanable funds, but without an expansion of genuine savings. In doing so, the loan market appears to be more solvent than it truly is, tricking the loan market into consummating unjustifiable loans. This artificially suppresses nominal interest rates below their natural level (i.e. where they should be pursuant to the true supply of savings). By expanding the money supply, this allows debtors/borrowers to pay creditors/lenders with devalued dollars, thus lowering the real rate of interest.

The essence of a credit transaction is an exchange of a present good for a future good. If there are no present goods (i.e. savings, which aren’t created on a printing press), then credit has to be curtailed. The problem in that case would not be a credit crunch, but a savings crunch. Investment can only come out of savings because producers must consume in order to sustain the process of production. In order for the baker to make more bread, the baker himself must eat. Thus somebody must forego present consumption in order to fund credit expansion.

The rate of interest is the discount rate of future goods against present goods. An example would be what an investor pays for a printing press. Suppose the printing press will generate $500,000 in net income throughout a ten-year life. The entrepreneur will certainly not bid up the price of the capital equipment to $500,000. The entrepreneur is willing to invest, say, $200,000 for the printing press and the vendor is willing to part ways with the printing press in exchange for an immediate $200,000. The entrepreneur and capital equipment vendor mutually settle upon $200,000 — a sum far less than the $500,000 — in exchange for the printing press.

How much present income (i.e. present goods) is an entrepreneur willing to invest in order to garner $500,000 in future net income (i.e. future goods) over a ten-year period? Reflected in the transaction is the rate of interest as determined by time preferences. Interest rates represent an agio on present goods since present goods are more valuable than are future goods. A person would rather eat an apple today than eat an apple ten years from now. Interest rates must be set pursuant to the true supply of savings and are determined by time preferences. If everybody wants to consume without saving, then interest rates must rise to reflect time preferences.

There is no right way to extend credit at negative real rates, which is a negative rate of return in real terms. It’s a calculus for the loan market to go bust. Any person, firm, or institution (e.g. government) that’s dependent upon inflationary credit expansion is, by definition, insolvent (i.e. a non-income generator). Failure has to be an option for bad business decisions. That’s the check on excessive risk taking.

Capital naturally gravitates to lower priced, higher-yield economies. It’s called arbitrage. Artificially low interest rates engenders capital outflow. Capital goes racing overseas. The problem isn’t a dollar shortage, but a dollar leakage. The dollars are out there; they’re just piled up in foreign reserves. The way to repatriate these dollars is for the Fed to tighten, interest rates rise, prices collapse to reflect wages, which will then beget capital inflow thus lowering the natural rate of interest. If I give you $10 in exchange for a book and you turn around and give me that $10 in exchange for a DVD, the real means of purchase for the book was the DVD and the real means of purchase for the DVD was the book. Increasing the quantity of dollars creates no benefit for the economy.

If the Fed tightens, while it’s true interest rates could gyrate upwards in the short term, the market wouldn’t take very long to append a deflation agio onto rates by lowering rates, since the real rate of return would come from an increase in the purchasing power of the dollar.

Myth: The FDIC is good for depositors

The FDIC offers deposit insurance for bank customers, which is really a backdoor way to bailout insolvent banks. Could you imagine being able to run a ponzi scheme (e.g. fractional-reserve banking), knowing that when your insolvency is exposed the government will pay off your customers (i.e. a de facto bailout of you)? This creates yet another layer of moral hazard on top of the central bank injecting “liquidity” into the loan market. Thus the FDIC’s true purpose is designed to keep the unsustainable intact.

Needing to insure bank deposits should raise questions in and of itself. Unlike natural disasters, economic risk can’t be pooled. It’s one thing to guarantee one’s solvency should they get wiped out due to, say, a flood. It’s quite another thing to guarantee solvency, per se. It’s impossible to insure against economic miscalculation and loss. In the insurance industry, this is referred to as speculative risk. If I were to go into business and you offered to insure me against business failure, by underwriting and assuming the risk, you become the true entrepreneur.

The FDIC (insolvent) is backed by the Treasury (insolvent) which is backed by the Federal Reserve (insolvent). The Federal Reserve is backed by a printing press, which is backed by the savings of Americans. Not only is the concept of insuring economic risk altogether chimerical, but there’s a reason why only a government-backed entity would offer insurance to banks. Inflationary (as opposed to non-inflationary) credit expansion makes banks inherently insolvent. Demand deposits are payable on demand, while banks are lent long. Thus the time structure of assets and liabilities does not match.

At the end of the day, the FDIC/Treasury/Federal Reserve (all three of which are insolvent) can guarantee depositors pull money out of their bank, but there’s no guarantee of the currency’s value. By guaranteeing solvency, this places the currency’s value at risk. Deposits are guaranteed in nominal terms, but not in real terms.

By scrutinizing the role of the FDIC more closely, you should see that its entire purpose is keeping the good ole’ boy network intact, leaving Americans with nothing. If the free market were allowed to function, the government’s role would be limited to enforcing contracts. If homeowners default, the bank would foreclose. But if the bank defaults, the bank’s creditors — i.e. its depositors — would become receiver for the failed bank’s assets. Depositors should be senior to all other creditors. Thus, in the event of a bank run, depositors have the first legal claim to a bank’s housing inventory.

What does the insolvent FDIC do? If a bank fails, the FDIC sends in federal regulators to protect the bank’s assets from its depositors by becoming receiver for a failed bank’s assets. In many instances, the FDIC has arranged shotgun mergers with investment banks on Wall Street, turning investment banks into bank holding companies.

So we can see this sleight-of-hand trick, under the guise of protecting depositors, transfers real assets (i.e. housing inventories) from failed banks to Wall Street, while promising depositors nothing more than globs of Fed “liquidity.”

There’s no way the FDIC/Fed can guarantee the solvency of the banking system or depositors, which will destroy the currency, thus destroying the very depositors – i.e. anybody holding dollars – those institutions are supposedly designed to protect.

The solution, then, is to put a failed bank’s assets into the receivership of its depositors. Any other efforts to prop up the housing or bond market will prevent the market from clearing and block those who have already lost homes from ever regaining possession. We are now doing to the housing market the same thing that has already been done to healthcare and education.

I would submit to you that we would all be better off the less government intervenes in the marketplace, no matter how well intentioned is the intervention. The less politicians do, the better off we will all be. Politicians spend a great deal of time promising to fix problems that they created in the first place. The “fixes” beget more problems. Senator Cortez Masto is no exception. Everything Senator Cortez Masto has supported has made housing increasingly unaffordable.

For those who have lost homes: If you want to figure out how to get your homes back, then make an inquiry into where they’ve gone. The Fed is sitting on over $1.5 trillion worth of mortgage-backed securities. We can go a long way toward saving the dollar, creating affordable housing, and getting people back into homes if politicians like Senator Cortez Masto fight to compel the Fed to disgorge the mortgage-backed securities on its balance sheet. Any other plan will engender homeless people and peopleless homes, which is why Senator Cortez Masto is the wrong barrister with the wrong indictment of the wrong suspect.

The Rise of the Wannabe Political Street Warrior

Antifa and the Alt-Right re-enact the political street combat of Weimar Germany.

“I can’t wait for the liberal genocide to begin,” exclaimed a demonstrator at a March 4 rally in Phoenix on behalf of President Trump, as an expression half-way between a sneer and a smirk creased his corpulent face. Asked by left-leaning independent journalist Dan Cohen to elaborate on what he said, the middle-aged man insisted that targeting political enemies for mass slaughter would be “a way to make America great again … it’s the liberals that are destroying this country.”

If the bloodletting this fellow cheerily anticipates were to ensue, he would be, at best, a spectator. He has taken too many trips around the Sun, and made too few trips to the gym, to be of any practical use in the hands-on business of eliminating the Enemy Within. Like most other people at that event, and others like it nation-wide, he was LARPing – Live-Action Role-Playing – in what could be seen as a contemporary re-enactment and updating of Weimar-era political street combat.

Mr. Liberal Genocide, who wore an Oath Keepers t-shirt, did display a little more sartorial restraint than the members of a group calling itself the “Arizona Border Recon” militia, who hovered at the periphery of the event in full desert military kit, striking poses of grim resolution.

“Nobody has respect for our servicemen,” complained one young female demonstrator, her voice thick with outrage. “They might not be government-affiliated, but they’re still servicemen, and they’re still working their butts off to make sure this country is safe. They might not tell you who they are, and that’s because they’re protecting their people.

I Will Fight You IRL

Unlike the valiant, if anonymous, members of the Arizona Border Recon, who seemed content with a bit of combat cosplay, California resident Kyle Chapman, aka “Based Stick Man,” actually threw down – sort of — with Black Block radicals at the pro-Trump rally in Berkeley on the same day. As each side’s shock troops tentatively engaged on the field of battle, Chapman – attired in hockey pads, a gas mask, what appeared to be a batting helmet, and carrying a plywood shield – pranced into the fray, swatting at Black Block cadres with a long stick that shattered quickly without doing any lasting damage. Not surprisingly, Chapman was instantly cyber-canonized as the “Alt-Knight.”

Several fights erupted at the March 4 events in Berkeley and elsewhere, a few dozen people were injured, and a comparable number of people were arrested. While politically inspired violence of any magnitude is at least troubling, these skirmishes had less in common with the war-to-the-knife confrontations between Freikorps and Spartacists in Weimar Germany than with the cosplay “Battle of Evermore” from the movie “Knights of Badassdom.”

There was an element of precautionary wisdom in that whimsical indie film: The socially marginalized LARPers in that story inadvertently unleashed a tangible, murderous evil. As Mr. Liberal Genocide’s blithe – and apparently sincere – endorsement of mass murder illustrates, through political cosplay people can become habituated into thinking in eliminationist terms: The “other side” is not merely gravely mistaken, but irreducibly evil, and since reason is unavailing the only option that remains is slaughter.

The Left/Right Sucker Punch

In “The Revolt of the Masses,” which was published in 1930 – a time when Mussolini was still in favor with the bien-pensants — the Spanish political philosopher Jose Ortega y Gassett observed that through Fascism “there appears for the first time in Europe a type of man who does not want to give reasons or to be right, but simply shows himself resolved to impose his opinions.”

That is to say, there nothing’s either right or wrong, but “winning” makes it so. This conceit isn’t limited to one end of the statist political spectrum: It encompasses both the Antifa and the Alt-Right. It was exhibited by the leftist nitwit who sucker-punched proto-Nazi Richard Spencer on the day of Trump’s enthronement, and by North Carolina resident John McGraw, who sucker-punched Rakeem Jones at a Trump campaign rally a year ago.

“Next time we see him, we might have to kill him,” McGraw told a reporter following the rally while he was still in the afterglow from the rapturous ritual of collective hatred. “We don’t know who he is – he might be with a terrorist organization,” McGraw elaborated, guided by the assumption that only depravity of that variety would inspire someone to oppose the Dear Leader. There are more than a few adherents of Trump’s personality cult who have explicitly called for the prosecution, imprisonment, or execution of those who criticize their idol.

When the Power Polarity Flips

Attendees at this year’s Conservative Political Action Convention energetically applauded the suggestion that the US government should revive an ancient Roman law allowing for the execution of citizens who “calumniate” – that is, defame – supposedly virtuous politicians.

“Let’s go back to ancient Rome,” urged CPAC speaker Robert Davi, a former actor who fashioned a career as a Trump-worshiping right-wing radio host once the offers to play TV and movie villains dried up. “If such laws existed today, we would see more men like Donald Trump and Mike Pence running for Congress or the Senate or the presidency and more fake reporters perhaps going to prison for the very lies they make up to commit cruel character assassination against the very best of our American heroes.”

In a similar vein, Fox News commentator Matthew Vadum has repeatedly called for critics of Trump, such as former CIA officer-turned-independent presidential candidate Evan McMullin, to be executed for “treason.”

The behavior of such Trump loyalists, it must be said, is not significantly different from that of first-term Obama supporters who accused the Tea Party movement of fomenting “sedition.”

“The entire right wing” is guilty of “sedition in slow motion,” by offering “incitement to revolt” against Obama, complained Sara Robinson of the Soros-funded Campaign for America’s Future in a 2009 essay. In similar terms, professor and MSNBC pundit Melissa Harris (who, with a hyphenated surname, later became notorious for an ad describing children as the collective property of “society”) said that by comparing Obama to despots like Hitler and Mao, the Tea Party was guilty of treasonous sedition.

“The Tea Party is a challenge to the legitimacy of the U.S. state,” declared Harris, without offering a convincing argument for the state’s legitimacy. “When Tea Party participants charge the current administration with various forms of totalitarianism, they are arguing that the government has no right to levy taxes or make policy.”

During the debate over Obamacare, Harris continued, “Many GOP elected officials offered nearly secessionist rhetoric from the floor of Congress…. They joined as co-conspirators with the Tea Party protesters by arguing that this government has no monopoly on legitimacy.”

This is exactly the same aria of civic outrage being performed by Trump-centric politicians and pundits today – albeit in a different collectivist key.

Eight years ago, it was the populist Right that chanted the “Not My President!” refrain, while the Left denounced them for their lack of “patriotism” and their defiance of the “rule of law.” Now what Lenin would call the Who/Whom polarity has shifted. Tea Party veterans who once saw rule by executive decree as the distillate of tyranny now thrill to every stroke of their president’s pen, and many of the same people who had upbraided Obama’s critics as less than patriotic are reconsidering the wisdom of nullification and interposition.

The Basest Appetite

Collectivist mass movements, warned Ortega y Gassett, aren’t organized around principles or ideals, but rather propelled by what he called “appetites in words,” particularly the basest appetite, which is a desire for power over others. Unlike the wholesale violence that our country saw in the late 1960s and early 1970s, contemporary street-level political conflict is heavy on posturing and pretense and light on actual bloodshed – but it does whet degenerate appetites that will grow to dangerous proportions as times get leaner and meaner.

Analyzing faux news with Alex Jones

Let me preface this by warning everybody that the government in Washington exists to protect Alex Jones from his critics. I’ve learned that myself, as it is apparently a transgression to call for people to pray for Alex, that his eyes would be opened, as I did. Just a few days ago, Alex on his show spoke about “strafing” his opposition – literally. Listen to his show. I perceive that as somewhat of a threat. Welcome to the Alex Jones World Order. Several days ago – anterior to the faux news debate – Alex literally called for shutting down CNN. It’s Wolf Blitzer, not Alex Jones, helping us identify the torturers: http://www.cnn.com/2016/11/09/politics/tom-cotton-waterboarding-torture/ There’s no room for heterogeneous thought in the Alex Jones World Order. It’s an order that will have the government harass you for merely wanting to escape its reign of terror.

Alex Jones recently invited everybody to analyze faux news. In this commentary, I take up his challenge. Here’s Alex trying to recruit thousands of fellow thought police:

VIDEO DELETED BY YOUTUBE

Alex spends time directing people’s anger towards Amy Schumer. Is Amy Schumer leaving the country? Isn’t she? Is Amy caught in a lie? It’s worse than tabloid politics because Amy Schumer isn’t even a politician. As Shakespeare said, be it thy course to busy giddy minds. This is distracting people with quarrels over transitory issues of little or no significance. Alex then talks about his favorite bogeyman – the abstraction called “globalism”. Waging a war on “globalism” will be as endless as is the war on “terrorism”. It’s all platitudes. While it’s true there are institutions of global governance that should be dismantled, President Obama’s warning against a “crude sort of nationalism” isn’t without merit. Opposing nationalism in no way implies support for “globalism”, nor does it validate anything Alex says. There’s nothing wrong with market globalism. As Frederic Bastiat said, if goods don’t cross borders, armies will.

Pursuant to Infowars, Ron Paul has even published a “hit list”. Yes. A “hit list” of people in the mainstream news. See: http://www.infowars.com/ron-paul-reveals-hit-list-of-alleged-fake-news-journalists/ Alex spoke very approvingly of the “hit list” in yesterday’s show. Does anybody know what a “hit list” means? To be clear, I’m not here to publish “hit lists”. I’m here to deconstruct faux news. Gentle reader, I couldn’t imagine what would happen to me if I published “hit lists”. Or what would be said about me if I endorsed the “hit list”? If I failed to do anything other than condemn it, as I do? Even condemning it will get me in trouble with somebody.

From a few days ago, here’s Alex Jones covering Steve Bannon’s recent interview:

VIDEO DELETED BY YOUTUBE (NOTE: I FOUND THIS VIDEO IS ARCHIVED RIGHT HERE: http://web.archive.org/web/20190123103347if_/https://www.youtube.com/embed/VQoh0ybEVc8?feature=oembed)

This one clip alone of Alex should be sufficient to convince his most die-hard followers to do an about face. It’s a museum-quality piece. There’s an emergency, alright. Alex has gone completely off the deep end. Alex’s coverage is very peculiar. He excises some of the most consequential information. It becomes self-evident that Alex amalgamates germs of truth with lies, contorts and omits truth, in order to smuggle lies past his audience. The Alex Jones sashay: ignore the consequential while dwelling on the inconsequential. Notice who Alex recommends people read. It’s not Henry Hazlitt or Ludwig von Mises.

Here’s one huge gem that Alex conveniently excises from at least two days worth of interview coverage:

“Like [Andrew] Jackson’s populism, we’re going to build an entirely new political movement,” Bannon says. “It’s everything related to jobs. The conservatives are going to go crazy. I’m the guy pushing a trillion-dollar infrastructure plan. With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything. Ship yards, iron works, get them all jacked up. We’re just going to throw it up against the wall and see if it sticks. It will be as exciting as the 1930s, greater than the Reagan revolution — conservatives, plus populists, in an economic nationalist movement.” See: http://www.breitbart.com/big-government/2016/11/18/steve-bannon-vows-economic-nationalist-movement-white-house-exciting-1930s-greater-reagan-revolution/

Alex Jones and Donald Trump inform us that China – not the government in Washington – is the biggest “abuser” of the United States. Pursuant to Jones and Trump, the most devastating weapon China has in its arsenal is currency manipulation. In other words, pursuant to the protectionists, renminbi devaluation is tantamount to an attack on the United States. But are the protectionists right? Is the Sinophobia justified? Do they not understand that interest rates are artificial? Are Jones’s ideas anything but a menace to the national security of the United States?

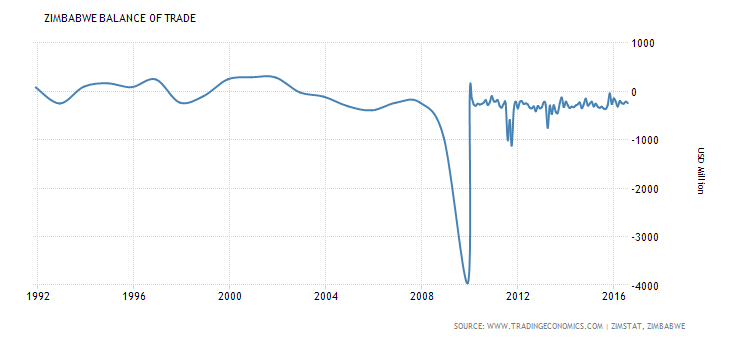

Prevailing practitioners of economics tell us that inflation stimulates exports. They get the flow of capital inverted. Otherwise, pray tell, why wouldn’t Zimbabwe be the world’s leading exporter? Inflation inflicts injury upon the manufacturing base, engendering capital outflow and the destruction of jobs.

Not only has Zimbabwe not been the world’s leading exporter, below is a chart that shows what happens to the balance of trade in juxtaposition with inflation.

Contrary to prevailing economic orthodoxy, inflation is not export-friendly. Inflation nurtures dependence upon cheaper foreign markets to supply us with production (i.e. begets capital outflow). Capital outflow can be reversed by compelling the Fed to tighten. If the Fed tightens, interest rates rise, prices collapse to reflect wages, the market clears (only then does the economic recovery begin), and dollars that have accumulated in foreign reserves will coming flowing back into the domestic loan market, thus lowering the natural rate of interest. Anything that nurtures sticky prices and/or wages will prevent the market from clearing.

“The dollar rose against most major currencies on Thursday as a latest report showed U.S. trade deficit plunged in February,” pursuant to one news source.[1]

“The contraction in the deficit came with a big recession-driven fall in imports and an unexpected rebound in exports, the Commerce Department said overnight in the US,” pursuant to another news source.[2]

In July of 2008, the dollar went through a rally – albeit a pseudo-rally – marked by falling nominal prices. Although falling nominal prices is not deflation (i.e. the contraction of the money supply, which would be a healthy thing), that’s the definition of deflation pursuant to prevailing orthodoxy. When the dollar rally began, the trade deficit declined, due to both decreasing imports and increasing exports. In other words: the fall in the trade deficit had been accompanied by a dollar rally. What prevailing economic orthodoxy teaches regarding inflation’s impact on capital flows betrays this possibility.

In November of 2007, Ben Bernanke put on an exhibition of his confusion when he said that inflation is inconsequential for everything but imports.[3] He literally said that dollar devaluation raises prices of everything not denominated in dollars! As if the Fed creating inflation has nothing to do with bond prices. Apparently, Bernanke was blinded by prevailing orthodoxy, which tells us that inflation mitigates a negative balance of trade – another Keynesian apologia for inflation that needs to be buried.

On a peripheral note, Bernanke’s argument runs slightly afoul of prevailing orthodoxy. Prevailing orthodoxy tells us that inflation does raise prices for Americans, and that this magically lowers real prices for foreigners. If Bernanke can’t figure out that increasing the supply of dollars raises dollar-denominated prices, then the average person is hopeless for understanding the international trade cycle and how capital flows.

The decline in imports and rise in exports in juxtaposition with the short-lived dollar rally were not a fluke, nor is this inexplicable. The trade “deficit” is but a symptom of monetary policy. A trade “deficit” isn’t bad per se. A trade “deficit” between two countries is no worse than a trade “deficit” between two towns. The consequential part is if the trade “deficit” is due to something other than comparative advantage (e.g. inflation).

“Suppose four-fifths of all the money in GREAT BRITAIN to be annihilated in one night, and the nation reduced to the same condition, with regard to specie, as in the reigns of the HARRYS and EDWARDS, what would be the consequence? Must not the price of all labour and commodities sink in proportion, and every thing be sold as cheap as they were in those ages? What nation could then dispute with us in any foreign market, or pretend to navigate or to sell manufactures at the same price, which to us would afford sufficient profit? In how little time, therefore, must this bring back the money which we had lost, and raise us to the level of all the neighbouring nations? Where, after we have arrived, we immediately lose the advantage of the cheapness of labour and commodities; and the farther flowing in of money is stopped by our fulness and repletion.

“Again, suppose, that all the money of GREAT BRITAIN were multiplied fivefold in a night, must not the contrary effect follow? Must not all labour and commodities rise to such an exorbitant height, that no neighbouring nations could afford to buy from us; while their commodities, on the other hand, became comparatively so cheap, that, in spite of all the laws which could be formed, they would be run in upon us, and our money flow out; till we fall to a level with foreigners, and lose that great superiority of riches, which had laid us under such disadvantages?” -David Hume, Essays, Moral, Political, and Literary, 1752

What mainstream economists teach runs contrary to what David Hume taught us in 1752. Hume describes arbitrage. Prevailing economic orthodoxy inverts the international trade cycle. We are told that inflation mitigates the trade “deficit”. By inflating the money supply, dollars will become less attractive to foreigners. Thus, runs the argument, foreigners will follow by curtailing exports to the U.S. Somehow, domestic productivity will magically be increased, stimulating exports.

The genesis of this error is begotten by the underlying macroeconomic assumptions. Rather than using microeconomic principles to understand macroeconomic phenomenon, mainstream economics fragments microeconomics and macroeconomics into separate compartments. Macroeconomics then becomes myopic, by lopping individuals out of its paradigm. Myopic macroeconomics doesn’t consider individuals; it only considers aggregates.

Translated, the macroeconomic analysis is this: the country has dollars. If the country, or nation – or whatever aggregate you wish to use – decides to print more dollars, the country, or nation, isn’t going to refuse to use its own dollars. However, the country, or nation, of, say, France, being a different country, won’t like very much the devalued American dollar.

I guess we aren’t supposed to ask why both inflation and the trade “deficit” have risen in juxtaposition with one another. Sound economics gives us that answer. If inflation did mitigate a trade “deficit”, then one is boxed into the position of currency-devaluation wars. Inflation vs. counter-inflation vs. hyperinflation.

The economy is made up of individuals making choices in exchanges. When the government devalues the currency, this doesn’t only make dollars less attractive to individuals abroad, but also to individuals right here at home. This is reflected with higher prices. It isn’t about aggregates printing more money for use by aggregates.

Inflation (i.e. the creation of money ex nihilo) disconnects sustenance from the satisfaction of consumer demands, diminishing the need to set market clearing prices. Consequently, inflationary stimulus interferes with the price mechanism preventing prices from falling to reflect wages. The market fails to clear, thus derailing an economic recovery. With mass unemployment, the last thing that will rise will be wages. The domestic cost of production goes up. Thus, to reduce costs, capital flight takes place. Inflation actually increases the dependence upon cheaper foreign markets to supply us with production.

As David Hume saliently articulated in 1752, inflation makes not only the currency less attractive abroad, but also the higher-priced goods. It also makes the higher-priced goods less attractive right here at home. Using inflation to remedy a trade “deficit” is akin to breaking a leg to make yourself more competitive.

The short-lived – due to central bank intervention – dollar rally in 2008 was not the consequence of the declining trade deficit; it was the cause of the declining trade deficit. Everything denominated in dollars becomes cheaper. It shouldn’t take a genius to figure out that one doesn’t become more competitive by raising prices.

It’s impossible to devalue the dollar to manipulate exchange rates without impacting any other prices. It might be true that devaluing the dollar will enable renminbi holders to purchase a greater quantity of dollars, but it will require a greater quantity of dollars to purchase goods and services. Therefore, real prices haven’t been lowered for renminbi holders whatsoever.

If inflation actually mitigated a trade deficit, Zimbabwe would be one of the world’s leading exporters. Inflation doesn’t lower real prices for anybody. But even if inflation did mitigate a trade deficit by lowering real prices for foreigners, while making things more expensive for Americans, why would that be a good thing? Why should American economic policy be calculated to make things cheaper for foreigners and more expensive for Americans? Economic growth – which is not measured by the GDP – engenders falling prices, which is a good thing.

Inflationary stimulus has served one purpose: preventing prices from falling to reflect wages. The market then fails to clear. The real issue isn’t even the direction of nominal prices, but what prices would otherwise be absent central bank manipulation. Even if prices fall in nominal terms while wages fall much faster, then we’re still suffering from the consequences of inflation. We can be suffering from lost price deflation. Falling nominal prices engender rising real wages.

Inflationary policy by the FOMC suppresses nominal interest rates by increasing the supply of loanable funds, but without a genuine expansion of savings to fund investment. Investment can only come out of savings since producers must be able to consume in order to sustain the process of production. Deploying printing-press money (i.e. unearned income) transfers money away from producers and the process of production to consumers. Inflationary stimulus disconnects consumption from production, turning Say’s law upside down. Thus inflation not only drives capital overseas, but begets capital consumption. Inflation is injurious to the process of production.

Interest rates are more than the cost of money. The essence of a credit transaction is the exchange of present wealth for future wealth. Interest rates are the discount rate of future goods against present goods. That present goods are more valuable than are future goods is why machinery doesn’t get bid up to what it will net. It doesn’t make economic sense to spend $2,000 on a vending machine that will net $2,000 over its lifespan throughout several years. The market’s discounting of machinery and equipment based upon future returns is called originary interest.

Increasing the money supply tricks the loan market into consummating unjustifiable loans to non-credit worthy projects. That’s why malinvestment occurs and projects are halted midstream with the revelation of malinvestment. By allowing debtors to pay back creditors with devalued dollars, real interest rates are suppressed. There’s no right way for the loan market to extend credit at negative real rates, which is a negative ROR in real terms. That’s a calculus for the loan market to go bust as it did in 2008. See: http://www.federalreserve.gov/releases/h3/hist/h3hist1.htm [now the information must be downloaded]. Check out the early months of 2008. That’s not psychological and that’s not a matter of consumer confidence.

The long end of the curve is most sensitive to market forces while the short end of the curve is most sensitive to FOMC policy. If the Fed stays loose to prop up the bond market, this will undermine the very bond market the Fed is trying to prop up. Investors/lenders will account for the inflation risk by tacking an inflation agio onto the curve. Eventually, the Fed will lose control over the short end, too. Under the scenario where the Fed stays loose, there will be no floor underneath the dollar nor any roof on interest rates.

Already, central banks seem to be the only buyers for mispriced bonds. As the Fed stays loose to prop up the bond market, this undermines the bond market in real terms, since other asset classes rise much faster.

Under the scenario where the Fed props up the bond market indefinitely, both the bond market and the dollar collapse. Dollars will hit parity with bonds. The Fed will be left with $18.5 trillion plus – in nominal terms – worth of bonds on its balance sheet, and we will be left with both junk bonds and junk dollars. The dollar itself will go bankrupt. What should be the true par value (i.e. redemption value) of bonds? We don’t know, because the Fed has been propping up the bond market.

Under the scenario where the Fed tightens, the bond market will decline in nominal terms, but the dollar will be saved and what’s left of real bond values will be salvaged. Dollars won’t hit parity with bonds. Just like investors/lenders tack an inflation agio onto nominal rates, there could very well be a deflation agio. Nominal interest rates could be set very low with the real rate of return coming from an increase in the purchasing power of the dollar. The only way to save the dollar is to stop propping up the bond market.

Until the Fed is compelled to tighten, we won’t have an economic recovery. The loan market has to set interest rates pursuant to the true supply of savings. If interest rates were to hit, say, ten percent on the two-year with a $18.5 trillion national debt, do the math. The longer interest rates are artificially suppressed, the higher they will have to go in order to correct the imbalances in the economy.

By tightening sooner rather than later, this will not only allow the market to discover the natural rate of interest by letting interest rates rise, this will encourage capital inflow. Capital naturally gravitates towards cheaper, higher-yielding, more efficient economies. It’s called arbitrage. The Fed is waging an eternal struggle against arbitrage. The Fed, through its war on low prices, has made the United States more expensive and lower-yielding.

If a person, firm, or institution is dependent upon inflationary credit expansion for sustenance, that person, firm, or institution is – by definition – insolvent. Somebody or some institution (e.g. government) is spending beyond their/its means. As a nation, we have spent beyond our means. Expenditures exceed earnings and we depend on foreign markets to supply us with production. We don’t suffer from a dollar shortage, but from a dollar leakage.

Inflation is no substitute for income-generating investment. Inflation creates pseudo prices and pseudo rates of return. Presently, there’s no right way to invest in the U.S. economy. It’s error to conflate trading with investing. Buying and selling real estate is not investing. Buying and selling equities is not investing. I’ll draw the distinction between trading and investing. A trader buys and sells a particular asset based on nominal price movements. An investor buys and holds a particular asset based on returns from the underlying asset itself. In the case of real estate, that would be rents. In the case of equities, that would be dividends.

The problem isn’t a lack of regulatory oversight. One can’t regulate away past mistakes. Insolvency can’t be regulated away. The only solution is to force up interest rates, prices fall, dollars that have accumulated in foreign reserves will flow back into the domestic loan market, which will then beget a lower natural rate of interest. Any other solution will lead to the destruction of the currency, in which case everybody’s savings get wiped out. Loose monetary policy to prop up a spending orgy engenders capital outflow (i.e. begets outsourcing).

Inflation is a tax. There’s no objective difference between the government taking the money you have in your pocket and duplicating the money you have in your pocket, thus devaluing the purchasing power of what you have in your pocket. Even if prices don’t rise in nominal terms, the real issue is what prices would otherwise be absent central bank manipulation.

Furthermore, if one is going to hold the position that rising prices is synonymous with economic growth, then they’re boxed into advocating skyrocketing prices in order to have fast economic growth. The way to have fast economic growth under such a scenario would be to have prices rise fast. I believe there’s a term for that. It’s called hyperinflation. Who supports hyperinflation?

The only path to an economic recovery runs through monetary tightening by the Fed. Waiting until we have an economic recovery before tightening is a calculus to destroy the currency and the economy. When the currency collapses is impossible to predict, but the currency will eventually collapse if current policies aren’t abandoned. We can prevent this if we change policy. Absent dealing with monetary policy, no politician offers us an economic solution. Forcing up interest rates means Washington relinquishing power. If Donald Trump can get away with talking about China’s management of the renminbi, there’s no reason why discussing the Fed’s management of the dollar should be taboo.

By buying dollars, China has helped postpone the day of reckoning. Having the Fed stay loose and asking China to buy dollars in perpetuity is like asking China to commit national harakiri. Renminbi devaluation would actually be injurious to Chinese exporters. If China really wanted to give herself an advantage, she would cease inflating and decouple from the dollar. Our real economic adversary is not in Beijing, but in Washington. Blaming China for our own failing policies is misguided at best. The solution is to abandon our own failing policies.

Objectively, the protectionist complaint about jobs “going” to China and China “cheating” on trade can be reduced down to there’s a problem with China buying dollars. How, pray tell, are jobs “going” to China other than the fact that dollars are going to China? How and why, pray tell, do dollars go to China? The tea party looks to be Bushism plus protectionism, which actually makes Bushism look very appealing.

Jones and Trump say nothing about dollar devaluation. From what I can tell, they want the Fed to stay loose, but they don’t want China to buy dollars. Having the Fed stay loose in juxtaposition with protectionism is very dangerous. They are ignoring the underlying problem while advocating more intervention to try to mitigate the symptoms.

Let’s pretend Jones and Trump are both honest persons and are genuinely confused, rather than dishonest. Confusion begets error, and error begets error. As I’ve articulated, Jones and Trump invert the flow of capital. It seems like that might be the genesis of their error.

Prevailing economic orthodoxy tells us that dollar devaluation is good for exports. But it’s impossible to devalue the dollar to manipulate exchange rates without impacting any other prices. It might be true that devaluing the dollar will enable renminbi holders to purchase a greater quantity of dollars, but it will require a greater quantity of dollars to purchase goods and services in the United States. Therefore, real prices haven’t been lowered for renminbi holders whatsoever.

Now let’s switch around dollar and renminbi holders. It might be true that devaluaing the renminbi will enable dollar holders to purchase a greater quantity of renminbis, but it will require a greater quantity of renminbis to purchase goods and services in China. Therefore, real prices haven’t been lowered for dollar holders whatsoever.

Suppose the PBC stays tight while the Fed stays loose. That would create even more lopsided arbitrage opportunities, in which case capital will flee to China at an accelerated pace. The old axiom about buying low and selling high is true, except in the world of central banking and the bond market. Do we really expect China to buy dollars while the Fed stays loose in perpetuity? Far from China being an adversary, China has helped postpone the day of reckoning by buying dollars.

Suppose the PBC loosens. Far from giving Chinese exporters an advantage, it would actually give Chinese exporters a disadvantage. If the Fed stays loose, China’s best course of action for its own national interests would be to tighten and decouple from the dollar – not unpeg, but decouple. Should Washington have the exclusive right to “print” the world’s “gold”? Why would China permit this in perpetuity? The one advantage that Washington has is that no government on earth wishes to abide by the discipline of a gold standard.

Renegotiating trade deals – as bad as some of them are – won’t repatriate capital. China’s loose monetary policy is not what “takes” our jobs. It’s Washington’s loose monetary policy. Capital naturally gravitates to cheaper, higher-yielding economies. It’s called arbitrage. If China tightened, becoming cheaper, that would precipitate capital outflow to China.

The idea that we can repatriate capital by adjusting nominal tax rates in juxtaposition with the Fed staying loose is a delusion. Does scapegoating China for our economic problems make it more or less likely we can attract Chinese capital? If the desire is to repatriate capital, then Jones should be demanding the Fed tighten and force up interest rates. When the Fed ceases inflating, we are back on a gold standard, because the only new money would be created through mining (i.e. a market transaction). There’s no need to make the dollar convertible, nor would making the dollar convertible be desirable, since that would be a price control like any other.

Imposing further regulations, restrictions, and capital controls as a makeshift effort to remedy capital outflow is a dangerous prescription that will result in economic dislocations. We need a plan to repatriate capital, not trap in capital. No plan to repatriate capital has been offered. Let no amount of patriotic sloganeering disguise protectionism as anything other than corporatism. It’s not about protecting jobs, but restricting access to cheaper markets for the non-politically-connected. If we reject the laissez-faire arguments against capital controls today, the resulting chaos will be met with demands for tighter controls tomorrow. I’m compelled to conclude that Jones’s ideas are a menace to the national security of the United States.

Back to faux news. Bad ideas pose no threat except when welded with state power, which can be diminished vis-à-vis monetary tightening. The solution to faux news is not censorship. The solution is more speech. Truth exposes Alex. Is Infowars faux news? I’m not here to play defense for the mainstream media, but I can’t possibly think of Infowars as a credible news source. Not only was Prince murdered by illuminati music executives, he was also killed by chemtrails. See: http://www.infowars.com/special-report-was-prince-murdered-by-illuminati-record-execs/ and http://www.infowars.com/did-the-chemtrail-flu-kill-prince/ We don’t need censorship. We need monetary tightening. The wonderful thing is here’s empirical evidence enough to convince the most recalcitrant central planners of the urgent need for monetary tightening. Loose monetary policy has adversely impacted Infowars, as there appears to be an Infowars bubble. At the very least, perhaps we can nationalize Infowars and make it non-profit, to then dismantle the operation. Remember, Alex indicts the Fed not for creating inflation, but for being a “private, for profit” enterprise.

[1] – http://news.xinhuanet.com/english/2009-04/10/content_11160595.htm

[3] – http://www.youtube.com/watch?v=nj9KHJRRUbQ – The consequential portion of the video is around the 5-minute mark. Inflation is not rising prices. To say so implies that rising prices are caused by rising prices. That contorts Irving Fisher’s own Quantity Theory of Money. Rising prices are the consequence of inflation, which is an expansion of the supply of money not redeemable in a fixed amount of specie. Prices could drop in nominal terms, yet prices could be too high in real terms. Falling nominal prices engenders rising real wages. We can still be suffering from inflation due to contortions in the price mechanism since prices remain higher than what they otherwise would be absent central bank policy.

Hillary Clinton, the spy

The FBI “saved” us from the Russians who are supposedly coming for our ETFs. Evgeny Buryakov is a Russian banker who was arrested for being a spy. Allegedly, he was going to destabilize the United States through ETF trading. Believe it or not, this isn’t a slapstick comedy. See: http://www.etftrends.com/2015/01/russian-spies-like-etfs/